Overview

In this article i'm going to share the elements i have found in the past 3 years of research on how to become a professional trader.I have read and taken notes from every article,forum or book i could find on the internet about trading and these are the steps i consider to be the most important in the journey one begins in the trading world.

1. What is trading?

Trading is participating in the global opportunities game. To be successful to any degree one needs to identify an edge, a slight skewing of the opportunities in one’s favor . Let's say we toss a coin 1,000 times and record the amounts of heads and tails, one could reasonable deduct that each occurrence would happen 50% of the time, now suppose one would add a small weight to one side of the coin, one could reasonably deduct that the weighted side would land bottoms down more then 50% of the time. Trading is very similar, a trader finds a way totilt the odds in his favor by identifying patterns and fine tuning entries to those pattern. A price moves up because there are more buyers then sellers, a buyer will buy a currency because he expects to be able to sell if at a later time for a profit, the more buyers think, feel or know the same the higher the price rises.

A trading system finds a way to make sense out of the chaos and tries to identify patterns within the price.

2. Success

Let's assume that a trader has identified an edge, a setup of an identification to a future price direction. The trader first needs to understand that every entry signal is different to any previous one, think about it; for the entry signal to be identical, every trader in the world that bought the currency previously, generating the initial entry signal would have to be present again to generate the same entry signal, of course this will never happen.

So every entry signal is different from a previous one. So how does the trader know the entry signal will result in a profitable trade? He does not.

A successful trader expects nothing out of each and every trade but is grateful when the trade turns into profit taking his money of the table and knows where and when to take his loss. He knows when is he is no longer willing to invest money on his entry signal, he reached the point where he recognizes that his entry did not result in a profitable outcome.

3. Balance

Now the trader needs to trade this enough times to get a good sample, let’s use the number 1,000 again. So after 1,000 trades the trader identifies that he is right 40% of the time, this does not automatically mean that his trading strategy is wrong. Once we enter a trade based on any signal, whether it is a Bollinger band touch, a MA, a volume based entry signal, a major support breach, a trend line, a channel, whatever it is we have two choices, when to get out and how long to stay in. If a system is only successful 40% of the time but the profitable trades average 30 pips and the losers 15 pips, a system could still generate 3,000 pips on every 1,000 trades. How to make a system profitable?

4. Profit system

The win/loss ratio is not the only important factor in a system, once a trader has identified an edge he now needs to find a large enough sample to see whether his profit for his winning trades is larger then his losses. So Weekly, Monthly, Quarterly and Yearly a trader needs to take stock over his entire trading history. A trader needs to continuously adapt his trading system. He needs to find ways to increase his edge, can he find better entries, can he find better exits, can he identify when his entry signal is wrong quicker. All of these measures can make any trading system profitable. So the only way to validate one’s “edge” over the market, one’s trading system is to trade it to get a large sampling using the same size lots for a significant large amount of trades. Then a trader needs to adjust his stops, his losses, his entries and his exits to make a trading system profitable as a whole. A trader would constantly work on fine tuning his system, not discounting it at the first hurdle.

5. Audit

As part of the audit process a trader needs to identify what currencies suit his trading system the best, he needs to identify what time frames suit his trading system the best and a trader needs to identify what trading hours suit his trading system the best. The audit stage of a system is the only way to identify strength and weaknesses in one's trading system and adjust for it accordingly.

6. Trading plan

The trading plan is the primary tool of every astute trader that respects himself. It must contain a very detailed scenarios about our trading activity .It must cover every aspect so that we can focus on reading the market action when we open the trading platform and not on details that could be set in advance.It must contain the answers to the questions :

- Why do we trade?

- When do we trade?

- Where do we trade?

- How do we trade?

- What do we trade?

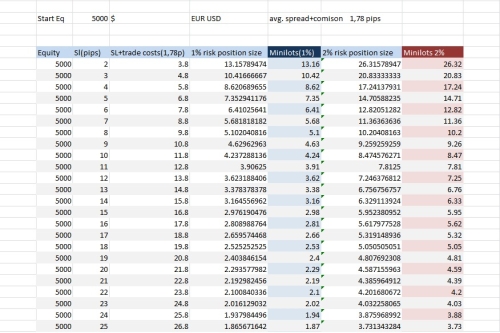

7. Money management, risk management and position plan

The astute trader must have a detailed risk management plan before he opens the platform an starts trading .For every parity he could trade he must have a position size spreadsheet already calculated ,so when the times comes to enter the trade all the risk management details are already taken care of.This includes entry/exit, take profit, stop loss, scale in size etc.

The above picture contains an example of an intraday scalping spreadsheet for EUR/USD.

8.Goals and objective plan'

This part should contain detailed statements about the type of trader we want to be, future progression, personal goals.Everything should be itemized and with a project calendar for each.

9.Audit process

Every trade we take should have a screenshot with how the market was like before we took the trade,during and after we closed the trade .Each day should have it's folder with trades and if we can write what we felt during that moment when we took the trade should be even better.Then at the end of every day, week, month, quarter and year we should review our trades and find ways to fine tune our trading system.

10.Surviving plan

[/b] This part should contain detailed risk protocols in place.I should contain a maximum daily/weekly/monthly/quarterly/yearly DRAWDOWN* according to your risk appetite and you STOP trading for that period if you hit it.

*The peak-to-valley decline during a specific recorded period of an investment, fund or commodity. A drawdown is usually quoted as the percentage between the peak and the valley.

11.Trading diary

The trading diary is what keeps all of the above organized and the final piece of the puzzle.It should also contain your random thoughts, emotions and feelings during that trading day.It can either be digital of if you want to stay classy you can use a swiss pen and a leather covered notebook .

Conclusion:In my humble opinion trading for a living is one of the best "jobs" you can ever have in this life to achieve financial freedom, but it's also one of the biggest competition on earth because the profit ceiling is very high .You need to have a professional attitude towards it and treat it like a business to be successful . A successful trading system is build by the trader himself to give him an edge over the market. Good trading systems are run by good traders that recognize that any edge can be fine tuned to make it profitable.

"We are what we repeatedly do. Excellence, then, is not an act, but a habit." Aristotle

The poor families who struggle to get the money during their daughter’s marriage will get some support through these government schemes. This scheme is limited to the daughters of Schedule Tribe, Scheduled castes, Backward cases, General class families of State and Minorities. shadi anudan status Uttar Pradesh government will bear these amounts through their annual financial budget and will move the agreed amount to eligible daughter’s poor families within a few months of marriage. Sadi Anudan does help the needy people and stands as back support who are seriously in need to do their daughter’s marriage.

ReplyDelete